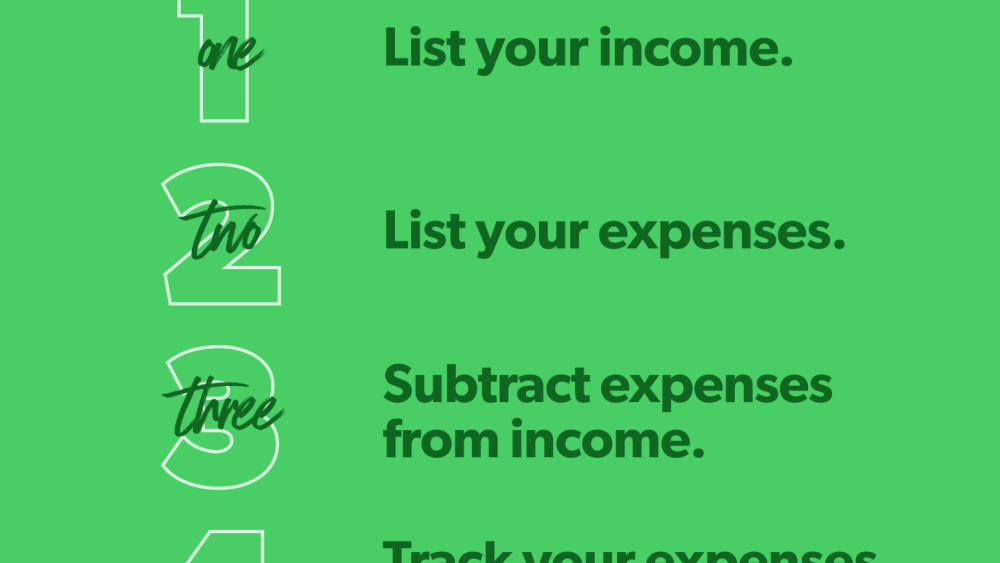

It may seem overwhelming at first but let’s take one step at a time... Here’s the steps:

- List Your Income

- List Your Expenses

- Subtract Expenses From Income

- Track Your Transactions

- Make a New Budget Before the Month Begins

WHAT IS A BUDGET?

Budgeting is taking control of your money and telling it where to go. It’s just plan...your plan. You can write it on a sheet of paper, use a spreadsheet or any money app. Try them all and see what works.

STEP 1: List Your Income

Income is any money you plan to get during that month—that means your normal paychecks and any extra money you receive through a side hustle, garage sale, freelance work or anything like that.

STEP 2: List Your Expenses

You know what’s coming in, now account for what’s going out. List your expenses. It works best if you have a bank statement to work from. Here’s what to Prioritize...FOOD, UTILITIES, SHELTER and TRANSPORTATION.

STEP 3: Subtract Expenses From Income

Subtract all your expenses from your income. This number should equal zero, meaning you just made a zero-based budget.

Zero-based budgeting just means you give every dollar a job to do: spending, giving, saving or paying off debt. It’s all accounted for and given a purpose.

If you subtract your expenses from your income—and you’ve got money left over? Don’t leave it there. You’ll end up mindlessly spending it on convenience store candy, and those one-click deals of the day. Get those dollars to work by putting any “extra” money toward your current financial goal.

What if you end up with a negative number? It’ll be okay. You just need to reduce expenses until your income minus your expenses equals zero. (Hint: Start with those eating-out and entertainment budget lines. You can’t spend more than you make. You’ve got this!)

If you’re still struggling to make ends meet, don’t forget the power of the second job, side hustle or overtime. Just remember not to increase your spending when you increase your income. Your extra cash needs to cover your budgeted expenses.

STEP 4: Track Your Transactions (All Month Long)

What am I talking about...Account for EVERYTHING that happens with your money all month long. As your tracking, make adjustments to your budget as needed. For example, if your gas bill comes in higher than expected then reduce your spending in another category.

STEP 5: Make a New Budget for next Month

Prior to the next month beginning, copy over your current budget and make adjustments based on what’s coming next month. The first few months are the most challenging. The most important aspect is that your accounting for your money and telling it where to go rather than wondering where it went.

THATS IT!

Give it a few months and find that budgeting is one of the most important financial decisions of your life.

Of course, Call me with any questions!